Crypto Currencies are on the Rise Again and Regulators are Taking Action

Categories:

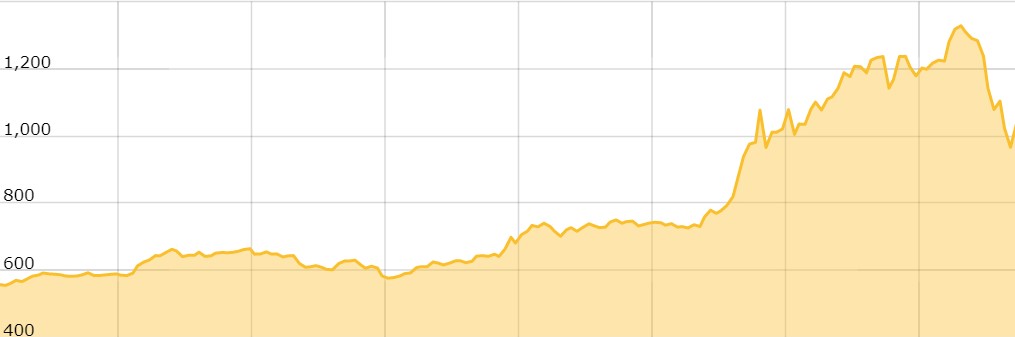

Cryptocurrencies are reliving a booming increase, similar to the one that happened during the mid-2018. This time crypto prices have accelerated into new heights, never seen in the industry.

Bitcoin reached an all-time high on the 8th of January surpassing the $42,000 mark. (chart was taken from cointelegraph.com)

Etherium corrected its price with the start of 2021 and as of the 10th of January reached an all-time high at $1,339. (chart was taken from cointelegraph.com)

This rise is not a phenomenon only among the top-notch cryptos as the majority of such currencies are seeing a tremendous increase. For example, Litecoin went from $74.70 (Dec 10, 2020) to $174.66 (Jan 10, 2021). (chart was taken from cointelegraph.com)

Cryptocurrencies and the Digital Era

It was 2009 when the first decentralised peer-to-peer payment system, Bitcoin, came to redefine the payment services sector. As of the 10th of January 2021, the global crypto market cap is $1.08T.

The Anti-Money Laundering Risk

The role of Cryptocurrency exchanges is rapidly becoming important in the financial industry. Criminals. The fact is that by being a new sector, crypto exchanges have many system gaps and are therefore more vulnerable to money laundering risks than other financial systems.

Cryptos are popular among individuals and entities alike, and firms serving crypto exchanges are finding it difficult to cope with AML risks. Due to the lack of regulations in the industry, criminal activity is greatly benefited from the gaps. Money launderers are avoiding heavy regulations in banks by converting the money into crypto money to clear the funds they obtained from their crimes.

According to Chainanalysis, in 2019 criminal entities moved 2.8 billion in Bitcoin to exchanges, up from 1 billion in 2018. As regulator punishments are getting stricter around transactions, criminals are expected to shift their attention towards digital and cryptocurrency in 2021 making for a far greater risk than it already is.

EU proposes Regulations on Cryptocurrencies

On the 24th of September 2020, the European Commission announced its first-ever regulations on Markets in Crypto-assets and amending Directive. The proposal suggests that the future of finance is digital therefore it is vital to mitigate any potential risks. The directive aims to reduce any risks for investors while protecting those issuing these assets.

As Valdis Dombrovskis (Executive Vice President, European Commission) stated, one of the aims of the new legislation is for the EU to reduce “market fragmentation” in this space.

The new directive implies that any crypto-asset firm authorized by one of the 27 EU states will be able to distribute its offerings across all the other members. The rules on stable coins issued will be strengthened as well.

CySEC Introduces its first Cryptocurrency Regulations

In late November, the Cyprus Securities and Exchange Commission (CySEC) issued its first regulations on cryptocurrencies. The aim of those rules is to ensure that all investments in cryptocurrencies are being covered by Cyprus Investment Firms so risks can be managed properly.

Singapore Joins the “Regulation on Cryptocurrencies Party”

A prime example of recently introduced laws is the update of the Payment Services Act and tighten AML controls on cryptocurrencies that the Parliament of Singapore has passed on the 4th of January. According to the updated Act, all cryptocurrency service providers must now obtain a license from the Monetary Authority of Singapore.

Recent Comments