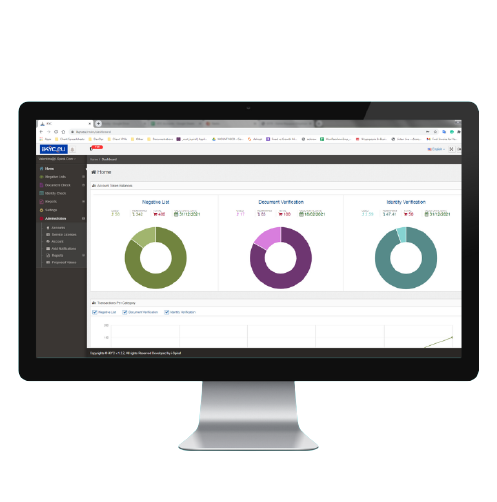

iSPIRAL has launched the most holistic KYC & AML solution to date, the iKYC.eu platform. The services can be accessed through web portal (accessible from PCs & smartphones) as well through APIs !

Your KYC & AML Solution

Accessed from Anywhere, Anytime

- Screening (PEPs, Sanctions, Adverse Media)

- Electronic Identity Verification

- Electronic Document Verification

- Fraud Risk Analysis

200

Satisfied Clients

8000

Users

12

Countries

Screening Search

PEPs, Sanctions, Adverse Media

Simple, Flexible Pricing Plans for PEPs, Sanctions, and Adverse Media Screening

Negative List Search

Determine with whom you can conduct business

A Solution which aggregates thousands of government regulatory and law enforcement watchlists, sanction lists and PEP profiles checked on a daily basis using global insights. The software offers reduced false-positive alerts and seamless single API integration.

- Screening (PEPs, Sanctions, Adverse Media)

- Global sanctions lists

- Adverse media coverage

- Ongoing monitoring

- Enhanced due diligence reports

- Law enforcements

Electronic Identity Verification

Digital Identity Verification

Verify over 100 million businesses and 4.5 billion people worldwide

Verify 4.5 billion identities using external data sources

To request a verification, you can send data such as Name, Address, Date of Birth, and National ID number, and we’ll instantly return the match results. Validate against hundreds of quality data sources – including sources from Telco networks, Banks, Consumer lists, Governments, Business Registrars and Utility lists – in 47+ countries.

- Verify Person from 2 different positive sources e.g. Governmental National ID database (2+2 Match)

- Verify Person from 1 positive source e.g. Governmental National ID database (1+1 Match)

- Video Identity Verification for 6 billion people

- Confirms validity of person (full name, address, date of birth)

- Applies custom verification rules based on different countries

- Use of public data, utility charges, postal address, telephone details etc.

- In line with each jurisdiction regulatory obligations

- Rapid, real-time identity verification

Electronic Document Verification

Authenticate ID documents effectively

Frictionless ID document verification technology ensures you, onboard legitimate customers, quickly and securely. Customers can capture images of ID documents (Passports, Identity cards, Driver licences) using a mobile device or webcam, and these documents are then fully authenticated using Artificial intelligence and Machine Learning.

- Verifies authenticity of documents (e.g. passports, ID cards)

- Check for Authenticity of MRZ Code

- Check for Tampered Information and Accuracy of Format

- Compare ID document template with actual uploaded document

- Check additional security elements such as holograms

- Check Crumpled/folded Edges and for Photoshopped Elements altered

- OCR Extraction of Data

Blog and News

Quality Read

FAQ

Frequently Asked Questions

Get the latest compliance information

What is Know Your Customer?

KYC is used to indicate all procedures that are being performed in identifying and verifying the legal entities and individual clients of a firm. Such processes include document verification and liveness detection, and are part of the client onboarding process.

Why is KYC essential for your Firm?

KYC is a vital process, enabling businesses to create an in-depth portfolio of their clients and report on information like if they are involved in any form of financial crime whether this is done intentionally or unintentionally

How does KYC fight Financial Crime?

KYC solutions are responsible for mitigating risk with primary focus is to verify the identity of your clients and analyse their behavioural activity and source of funding.

Screening (PEPs, Sanctions, Adverse Media)

Uses thousands of regulatory and law enforcement databases for client identification and creates an in-depth map of clients including detailed profiling of entities and other individuals related to them. Most valued and competitive database intelligence used today in screening and is differentiated from its competitors by price and ongoing monitoring.

- Politically Exposed Persons (PEP) lists.

- Global Sanctions lists.

- Adverse Media coverage.

- Ongoing Monitoring.

OCR for Utility Bills for Proof of Address

Optical character recognition (OCR) is a common method of electronically converting typewritten or printed text into machine-encoded text e.g. using utility bills.

Fraud Risk Analysis

Provides a real-time and to-the-point risk scoring, reputational data and gets updated based on information gathered from monitoring. It also monitors all images displayed by selected accounts in social media.